[Click by the study group]

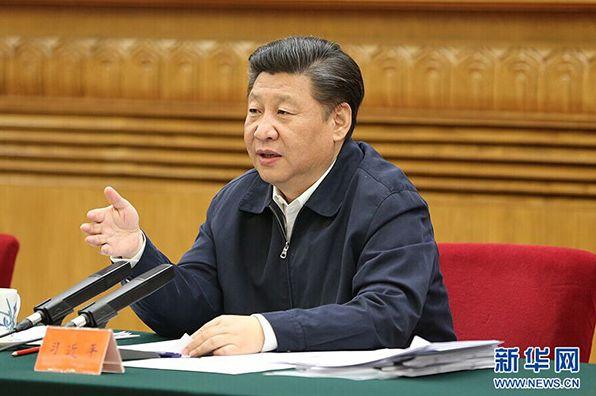

Five years ago, from August 19th to 20th, at the National Conference on Propaganda and Ideological Work, the Supreme Leader emphasized that we should "have the overall situation in mind, grasp the general trend and focus on major issues" and "make efforts according to the situation, move according to the situation and follow the trend." Among them, news and public opinion work is at the forefront of ideological struggle.

Since the 18th National Congress of the Communist Party of China, the top leaders have made macro-thinking and strategic layout on the new situation and new tasks faced by the party’s news and public opinion work.Put forward many new ideas and new ideas.Today, the group sorted out this for the team members to learn and think about.

[Positioning: "An Important Work", "An Important Event" and "Five Issues"]

The party’s news and public opinion workIs an important work of the party.It is a major event in governing the country and ensuring national security.

Do a good job in the party’s news and public opinion work,

concerningFlags and roads,

concerningImplement the Party’s theory, line, principles and policies,

concerningSmoothly advance various undertakings of the party and the state,

concerningThe cohesion and centripetal force of that whole Party and the people of all ethnic group,

concerningThe future and destiny of the party and the country.

News media is an important position for various forces to compete for, and news and public opinion work is at the forefront of ideological struggle.

[Duty and Mission: "48 words"]

Hold high the banner, lead the way,

Focusing on the center and serving the overall situation,

Unite the people and boost morale,

Become a civilized person, gather together,

Clarify fallacies, distinguish right from wrong,

Connect China and foreign countries and communicate with the world.

To undertake the duty and mission of news and public opinion work, it is the first to adhere to the correct political direction.

[Working principles and principles: 4 firmly adhere to]

The essentials of news and public opinion work

Firmly adhere to the principle of party spiritThe most fundamental thing is to uphold the party’s leadership over news and public opinion work;

Firmly adhere to the Marxist view of journalismTake it as the "fixed star" of the party’s news and public opinion work;

Firmly adhere to the correct direction of public opinionDoing all the work is conducive to upholding the Communist Party of China (CPC)’s leadership and socialist system, promoting reform and development, enhancing the unity of the people of all ethnic groups throughout the country, and maintaining social harmony and stability;

Firmly adhere to positive publicity.Always regard unity, stability, encouragement and positive publicity as the basic principle that the party’s news and public opinion work must follow.

The media sponsored by the party and the government are the propaganda positions of the party and the government.Must be surnamed Party.

[Innovation: More needed than ever]

"News propaganda is good at innovation, whether it can be done often and often, is itsThe key to developing and maintaining strong vitality."

"Doing a good job in propaganda and ideological work requires innovation more than ever."

When inspecting the PLA newspaper, I stressed that news and public opinion work must be adhered to."Innovation is the most important".

"Attach great importance to the construction and innovation of communication means and improve the communication, guidance, influence and credibility of news public opinion."

The party’s news and public opinion work must be innovated.Concept, content, genre, form, method, means, format, system and mechanism, enhance pertinence and effectiveness.

It is necessary to adapt to the trend of differentiated and differentiated communication.Accurately locate the audience, be good at setting topics, form an all-round, multi-level and multi-voice mainstream public opinion matrix, and accelerate the construction of a new pattern of public opinion guidance.

It is necessary to promote integrated development.Take the initiative to use the advantages of new media to create a number of new mainstream media and occupy the commanding heights of information dissemination.

We should seize the opportunity, grasp the rhythm and pay attention to the strategy., from the time and efficiency, reflecting the time and efficiency requirements.

[Deploying online news and public opinion work: the relationship between ideological security and political security.】

On August 20th, the 42nd Statistical Report on Internet Development in China showed that,The number of netizens in China topped 800 million.Facing the profound changes in media structure, public opinion ecology, audience and communication technology, the Supreme Leader pointed out that,

Internet has become the main battlefield of public opinion struggle. On the battlefield of the Internet, whether we can stand up and win is directly related to the ideological security and political security of our country.

It is necessary to improve the comprehensive management ability of the networkTo form a comprehensive network management pattern with the participation of multi-subjects, such as party Committee leadership, government management, enterprise responsibility, social supervision and self-discipline of netizens, and the combination of economic, legal and technical means.

To conform to the general trend of Internet developmentBe brave in innovation and change, and make use of the characteristics and advantages of the Internet to promote all-round innovation in ideas, contents, means, systems and mechanisms.

It is necessary to strengthen Internet thinking and the concept of integrated development.Promote the effective integration of various media resources and production factors, and promote the sharing and integration of information content, technology applications, platform terminals and talent teams.

It is necessary to enhance the sense of position.Dare to speak out, dare to show your sword, grasp the initiative in the online public opinion field as soon as possible, and cannot be marginalized.

It is necessary to strengthen the construction of network content, strengthen the positive publicity on the Internet.

We should grasp the timeliness and effectiveness of online public opinion guidance., make the cyberspace clear.

[Tell the story of China to the world and make China sound]

International communication ability:There are "deficit", "contrast" and "gap" in "other molding" rather than "self-molding"

International public opinion patternAt present, "the west is strong and I am weak"The international communication ability of China’s news media is not strong enough, and the voice is generally small and weak. The major western media influence world public opinion.

China’s image in the world is largely.It is still "other plastic" rather than "self-plastic"In the international arena, we are sometimes in a situation where we can’t say what is reasonable and can’t spread it, and there is information."deficit" in and outThe true image of China and the subjective impression of the West."contrast"Soft power and hard power"gap".

It is necessary to tell the story of China well, give voice to China and explain the characteristics of China.Let the world know a colorful China.

We should strengthen the right to speak internationally, strengthen the construction of the discourse system of external communication, and create new concepts, new models and new expressions that integrate China and foreign countries.

We should make great efforts to strengthen the capacity building of international communication.Optimize the strategic layout, concentrate superior resources, and strive to build a flagship media with strong international influence, so that the whole world can hear and hear the voice of China.

[The key lies in people]

"media competitionThe key is talent competition., media advantageThe core is talent advantage.. "

"Accelerate the cultivation of a news and public opinion work team with firm politics, exquisite business, excellent work style and reassurance of the party and the people."

"four to four":

Adhere to the correct political direction and be a politically determined journalist;

Adhere to the correct direction of public opinion and be a journalist who leads the times;

Adhere to the correct news ambition and be a skilled journalist;

Adhere to the correct work orientation and be a journalist with excellent style.

Emphasize that the work of propaganda and ideological departments should be strengthened, first of all.Leading cadres should be stronger, and the team should be stronger.

It is necessary to choose a leading group with strong strength.Select and make good use of cadres who have both ability and political integrity and truly "have two brushes", and resolutely make adjustments to those who are not suitable for adaptation.

It is necessary to "gather talents from all over the world and use them"To implement a more active, open and effective talent policy and deepen the reform of the cadre and personnel system in news organizations, the party and government departments should fully trust journalists politically, use them boldly in their work, care sincerely in their lives and guarantee their treatment in time.

It is necessary to establish the working concept of "big publicity"

Mobilize all fronts and departments to do it together, and combine propaganda and ideological work with administrative management, industry management and social management in various fields more closely.