"internet plus", how to do this addition?

Carry out the "internet plus" campaign, promote "Internet+government services", promote "internet plus" in medical care, old-age care, education, culture, sports and other fields, develop "Internet+agriculture", and use "internet plus" to develop new employment forms … In this year’s government work report, "internet plus" has become a high-frequency word, and it has also become a hot topic for deputies these days.

"In our remote island, we used to have to ask people to bring things. Now there are 200 to 300 packages from e-commerce every week. I also teach fishermen on the island to use the mobile phone program of our postal’ postal music shop’ to help them sell dried fish and dried shrimp to the whole country. The power of’ internet plus’ is so great." The words of Xie Jian, deputy to the National People’s Congress and courier of China Post’s business office in Wailingding Island, Zhuhai, Guangdong Province, represent everyone’s voice. In many fields, such as circulation, manufacturing, people’s livelihood security, public services and so on, the energy of "internet plus" is being continuously released. What is added to this addition of "internet plus"? What should I do with this addition in the future?

Real economy "accelerator"

At present, "internet plus" is widely used in the real economy, becoming an accelerator for the continuous transformation of new and old development kinetic energy. Lin Shuiqi, deputy to the National People’s Congress and chairman of Guangdong Jinling Sugar Group Co., Ltd., told reporters that they have invested more than 80 million yuan to transform smart farmland. In the transformed farmland, watering and fertilization can be directly and remotely controlled by mobile phones. "This year, 100 mu will be piloted, and it will be extended to 10,000 mu in the future. This is not only to save labor costs, but more importantly, it can achieve precise control, thus producing better products. This is also the only way for structural reform of the agricultural supply side."

The integration of "internet plus" and manufacturing industry is more rapid. Tan Xuguang, deputy to the National People’s Congress and chairman of Weichai Group, said that great changes have taken place in the design, production and sales modes of the manufacturing industry through the "internet plus". "In terms of intelligent manufacturing, it is a collection of three elements, namely automation, digitalization and videoization of human-computer interaction. The intelligent manufacturing of Weichai Group has been implemented for five years. Last year, we produced 620,000 engines. Without intelligent manufacturing, this achievement would not have been possible. Intelligent manufacturing is to use Internet technology to improve efficiency and reduce costs. "

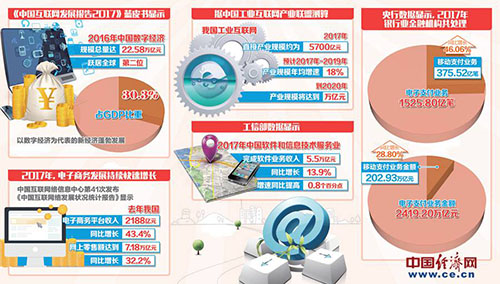

The energy of "internet plus’s real economy" also lies in the birth of a series of "four unlike" new formats, new models and new industries. Ding Lei, member of Chinese People’s Political Consultative Conference and chairman of Netease’s board of directors, said: "For example,’ internet plus Express’ derived e-commerce,’ internet plus Auto’ derived driverless driving, and’ internet plus TV’ derived smart home appliance platform. In addition, there are commodity crowdfunding, sharing economy, O2O and on-demand customization. These new faces are also the embodiment of the’ internet plus real economy’. "

According to Fan Qingfeng, deputy to the National People’s Congress and secretary of the Party Committee of ZTE, with the continuous upgrading of infrastructure, the integration of "internet plus" and the real economy will be more powerful. "The biggest advantage of 5G is its high speed, low delay and wide connection. It truly realizes the interaction between people and things, things and things, which has a great impetus to the upgrading of manufacturing industry. In the future, repetitive, high-intensity and harmful jobs on production lines can be realized completely through robots or industrial automation instruments." According to the forecast of China ICT Institute, by 2030, the commercialization of 5G technology will drive China’s economic output to 6.3 trillion yuan and create 8 million jobs.

People’s livelihood security "fills the shortcomings"

If the integration of "internet plus" and the real economy is a icing on the cake in a sense, then the assistance of "internet plus" in education, medical care, old-age care and employment is more like "sending charcoal in the snow". Through cloud computing, big data and artificial intelligence, all kinds of shortcomings that were difficult to deal with before are being broken.

Yao Jinbo, deputy to the National People’s Congress and CEO of Group 58, is optimistic about the promotion of the employment of the disabled by the internet plus. "Many jobs actually don’t reject the disabled, but the problem is that the information is too asymmetric. If we can use the Internet to build a database and truly match the characteristics of each disabled person with the job intelligence, we can really solve this problem, especially if we can connect with the database of the Disabled Persons’ Federation and the civil affairs department, we can help disabled people find jobs that are suitable for them. "

Wang Qian, member of Chinese People’s Political Consultative Conference and president of Shaanxi Big Data Group, is optimistic that "internet plus" will become a "shortcut" to solve the problem of providing for the aged. "On the one hand, we will build a’ data overpass’ between medical institutions at all levels and resources for the aged, so as to accurately grasp the number of elderly people, medical history and economic situation. Using the technical means and modes of big data, we will establish a big data management and intelligent analysis platform for healthy old-age care, and accurately predict the structure and market demand of the elderly population. On the other hand, we will increase R&D support for health care equipment such as health management wearable devices, portable health monitoring devices, and intelligent old-age monitoring devices, provide’ nursing homes without walls’ services for the elderly, and create a’ elderly+platform+service’ home care service model. "

Solving the problem of "difficult to see a doctor" and "expensive to see a doctor" is the main practical direction of "internet plus" in the field of people’s livelihood. Li Weimin, deputy to the National People’s Congress and president of west china hospital, said that the Internet supports the development of medical care in two aspects. First, it is more convenient for patients. For example, patients can make appointments for registration, payment, examination and admission, etc. through the Internet. Second, "Internet+medical care" can play an important role in chronic diseases and health management. Through Internet video consultation, video follow-up, video guidance, etc., patients can be treated by trusted doctors without going to the hospital.

Ma Xiuzhen, member of Chinese People’s Political Consultative Conference and director of the Health and Family Planning Commission of Ningxia Hui Autonomous Region, said that there are insufficient high-quality medical resources in the western region, and the use of "Internet+medical care" can help people in the western region get better medical services. "Ningxia has initially established a telemedicine network, and also introduced an Internet medical third-party platform as a professional operator, which has handled multi-point practice filing for 16,000 experts across the country in Yinchuan, becoming a remote expert database that can provide online support at any time."

However, Committee member Chinese People’s Political Consultative Conference and Sogou CEO Wang Xiaochuan also said that "Internet+medical care" has only taken the first step at present. "I suggest to build a new medical association, widely connect high-quality resources to patients’ ends through digital technology, and open up the’ last mile’ of medical care for the benefit of the people, and provide a three-level supply model of’ core hospital+primary health service institutions+digital family doctors’, in which’ digital family doctors’ can intelligently triage and register directly online. It can also provide remote video and voice diagnosis, and even assist image pathological diagnosis, query reports, record electronic medical records, pay online medical insurance, and continuously track and monitor patients and provide intelligent health consulting services. "

"New Face" of Public Service

This year’s government work report proposes to further promote "Internet+government services" so that more matters can be handled online. Outside the industry, with the promotion of smart cities, "Internet+government services" also make enterprises and people feel new convenience.

Shen Xiaoming, deputy to the National People’s Congress and governor of Hainan Province, said that Hainan has actively used Internet innovation to optimize social management, and has built information platforms such as market supervision, global tourism supervision services, disaster prevention and mitigation, and provincial population access management systems to strengthen the acquisition and application of social management big data. At present, all non-confidential information systems in Hainan are connected to the information sharing and exchange platform, and the information sharing of government departments reaches 99%. Liu Yi, deputy to the National People’s Congress and mayor of Jiangmen City, Guangdong Province, said that Jiangmen opened the pilot service of Guangdong, Hong Kong and Macao through trains in Guangdong Province, realizing the offshore acceptance and remote processing of commercial registration in Hong Kong and Macao. "The next step is to continue to promote the unified and standardized docking of administrative service halls, online service halls and departmental approval service platforms with inventory data in the city, and accelerate the construction of online approval and supervision platforms for investment projects, and strive to make the first breakthrough in the reform of investment project commitment system in the province and even the whole country."

In the opinion of the deputies, "Internet+government services" is an important means to improve the business environment. Ma Jun, a member of the Chinese People’s Political Consultative Conference and a professor at henan university of economics and law, said: "This will help promote the reform of the’ streamline administration, delegate power, strengthen regulation and improve services’, build a higher level service-oriented government, innovate institutional mechanisms, optimize work processes, strengthen service concepts, and improve the ability to serve enterprises, institutions and the people." Xia Fei, member of Chinese People’s Political Consultative Conference and president of Guangxi University of Finance and Economics, suggested that "Internet+government services" should be vigorously promoted to improve the efficiency of government services, and governments at all levels should be urged to put the optimization of business environment into the focus of administrative efficiency monitoring, accelerate the reform of administrative examination and approval system, continuously improve the social credit system and continuously improve the efficiency of customs clearance.

With the promotion of public services, the importance of government data assets is increasing. Commissioner Wang Xi said that the basis of "Internet+government services" is the open sharing of government data, and the ownership, management and management rights of government data are not clear at present. "Take precautions, and now we should carry out forward-looking research to provide theoretical basis for establishing a management system for government data assets; Strengthen policy guidance and clarify the top-level design of ownership management of government data assets; Combined with relevant pilot projects, explore the establishment of ownership management and legal system of government data assets; Encourage the application of new technologies and support the sharing, opening and development of government data with clear responsibilities and rights. (Economic Daily China Economic Net reporter Chen Jing Huang Xin Zhou Lin)